A Housing Crisis in Three Acts: Act One, Buy the People, For the People

Wall Street funded technocrats, in the comfort of their Austin, TX mansions are using AI to steal homes from underneath working class noses.

If you know about the World Economic Forum you’ve heard their famous line “You Will Own Nothing and Be Happy!”

Anyone who’s been down an internet rabbit hole or finished a full episode of the Joe Rogan Experience has heard about the Bill and Melinda Gates Foundation and the CCP, or Chinese Communist Party, buying farmland on a massive scale so that it’s under their control.

So, what if I told you there was a Property Management Company that exists as an empty shell for an investment broker, funded by Wall Street buying up all the homes in your area by the thousands to put up for rent, and using AI to find the homes, buy them, and dispatch the right crew fix the home up, and to manage the maintenance, the rent, work orders, everything, at slumlord quality? Every time a house comes up for sale, they buy it off the market before anyone else gets a chance to, and doesn’t take no for an answer. Using AI, and offering cash payment. It’s a dream for the seller, but every single other person involved get’s the shaft!

What if I told you the entire outfit was led by one man who is only seen outside his Austin, TX mansion when he appears on Bloomberg News, and other business-related outlets, such as Vanguard, to—I shit you not—tell homeowners to “sell your homes now and buy them back later” if they want, of course.

That’s what I uncovered here in Kentucky, and it’s coming to a neighborhood near you! Lemme explain…

Here in Kentucky a Real Estate Agent's busiest times are on the weekends, in an attempt to counter the disappearance of quality homes from the market. Houses hit the market en masse on Thursday and Friday, and if the realtors can’t get them back off the market before these deep pocket parasites come in, the homes just disappear. They have until Sunday at the latest, if they’re lucky, then the homes just evaporate like they were never there. Some of them never make it to a real estate agent. This company’s program is able to scoop them up in as soon as 12 hours after they’re listed. So, is there thousands of corporate pockets with bottomless bank accounts out there doing this? Actually, just one.

According to sources from the frontlines, “that’s not the end of the battle. If the company gets their eyes on the home, there’s nothing that working people who are just trying to get a home could do about it. This happens to over half of the homes that he can get a family into the process of purchasing, they then go directly to the seller and offer an extra 20-40k over the asking price and offer cash up front, they steal these houses away from good, hard working people who just want a home, by offering things that no working person could offer, so regular people are stuck taking homes in rougher neighborhoods that the big companies don’t want.” So, who is the company?

Meet Main Street Renewals

Meet “Main Street Renewals, where we will own everything, and you will NOT be happy.”

So, this company’s entire goal, looking at it from the street view, is to own every home in Kentucky and surrounding areas. They use AI flamboyantly for everything including maintenance requests, applications, rent, everything. While the king of this empire of rental homes sits, high on the hog, in Austin, TX. If you try to contact them you get a computer, or AI, answering service, and they also use this to swoop in and take homes out from underneath working people and good realtors who are just trying to get people into homes.

They’re able to do this by setting parameters for their AI program they’ve developed, but people are different, they have unique situations, and if you want to own every home you must own every unique situation. So, let’s talk about some of these parameters their AI system follows.

These are quoted directly from their website

Pets (Maybe I’m animal-crazy but these made me the maddest)

Up to 4 pets per household including any aquarium and each small cage animal are allowed.

The maximum combined weight of all animals is not to exceed 300 lbs (excluding any cages or aquarium).

The following list of dog breeds are prohibited:

American Staffordshire Terriers

American Pitbull Terriers

Rottweilers

Doberman Pinschers

Any dog that has a percentage or mix of any of the above breeds

Any canines other than dogs and hybrids thereof

Small animals such as gerbils, hamsters, and guinea pigs are permitted with the exception of the following:

Ferrets

Rabbits

Chinchillas

All dogs and cats must be neutered / spayed. The Resident will maintain a valid vaccination certificate issued by a licensed veterinarian or a state or local authority empowered to vaccinate animals (or a designated agent of such authority) stating that the animal has received all vaccines required by applicable state and local law. It must include the animal’s name, description, age, date, and type of vaccination.

Any animal that is not a dog or cat normally found in the wild (This is hilarious, I had to include it.) including:

Skunks (Whaaaaat! No Skunks!? What about Le Pew???)

Raccoons

Squirrels

Monkeys

Oh, and no 🐔chickens, 🐮cows, or 🐐goats.

Renters Insurance: We require renters’ insurance for all our homes. *You must have this before you can even apply*

Pet Policy: We love our furry friends (unless they’re a certain breed or weight. Imagine if it said blacks were not permitted because of the levels of crime in black neighborhood's, or Arab’s aren’t allowed because of 9/11, I think it’s the same to ban entire breeds of animals. Remember, they want to own everything.)

Credit and Criminal Screening: All leaseholders will undergo credit and criminal screenings conducted by TransUnion. Criminal screenings ONLY will also be performed for all adult occupants (18 years and older).

So, because they have taken all the homes, you could be living in a tent due to bad credit.

We will begin our review process once both the application is submitted and the non-refundable $50 application fee has been paid for all applicants 18 years and older.

When my Susan and I, submitted an application it costed us $100 and they denied our application before we finished filling it out and took the money. $100 was 25% of my paycheck, for people living paycheck to paycheck it’s devastating. We were trying to find a home and got stuck between eating for the week and filling out an application that will probably get denied. We tried to contact someone to find out why we got denied and if we could use that same application for a different home that we could be approved for and all we got was this automated computer answering shit. So, their AI doesn’t even work well.

We will verify the identity of the primary leaseholder on the application by first asking a few questions from your credit file provided by TransUnion. Next, we will ask you to take a photo of your government issued ID and scan your face using a mobile device via Plaid, our trusted third-party service provider. To quickly approve your home, we use Bank Connect via Plaid to verify your income from the last 90 days. All leaseholders will be able to add their income into Plaid if needed to prove the required combined gross monthly household income of at least three times the monthly rent.

The reason they can overbid the realtors trying to sell their homes to an individual who wants their own home, is their extraordinarily high rent, and in order to qualify your income must be 3 times higher than the rent. Sorry, regular working people, here in Louisville, KY, do not make $6,000 per month, they just don’t. I don’t even know anyone here who makes that much.

Or they low-ball with cash, the seller can’t turn them down and they swoop in before anyone else gets the chance.

These are some of the parameters that their AI program is supposed to be trusted with, and I can’t stress this part enough, THEY ARE BUYING THESE HOUSES RIGHT OUT FROM UNDERNEATH WORKING PEOPLE WHO WANT TO OWN A HOME. THEY ARE BUYING ALL THE HOMES SO YOU MUST RENT FROM THEM, THEN SETTING PARAMETERS THAT ARE DAMN NEAR IMPOSSIBLE TO FOLLOW. THE NEW HOUSING CRISIS WILL BE “NO ONE GETS TO OWN ANYTHING”, THEY DID IT, IT’S HERE.

I seen an overview of Carol Roth’s book, “You Will Own Nothing” about this phenomenon—I don’t know who writes those things, but it summed up what I’m saying very well:

From declines in home and vehicle ownership to global inflation and government spending, many of the trends of modern life reveal that a new world that is emerging—one in which Western citizens, by choice or by circumstance, increasingly do not own possessions or accumulate wealth. It’s the perfect economic environment for the rich and powerful to solidify their positions and prevent anyone else from getting ahead.

In You Will Own Nothing¸ Roth reveals how the agendas of Wall Street, world governments, international organizations, socialist activists, and multinational corporations like Blackrock all work together to reduce the power of the dollar and prevent millions of Americans from taking control of their wealth. She shows why owning fewer assets makes you poorer and less free.

I’m not the first to cover this story, local news network here in Louisville was talking about this back in 2018, here’s what they found:

The house in the Indian Falls subdivision is ultimately owned by a company linked to Luxor Capital, a New York hedge fund. Since February, Luxor Capital has purchased 86 single-family homes in Louisville, according to Jefferson County property records.

Since late 2015, these investors – backed by hundreds of millions in cash – have bought more than 400 single-family homes in middle-income areas of Jefferson County

For the first 15 years of its life, the house the Rileys rented was occupied by its owner. But Wells Fargo bank foreclosed on it in 2015, and Main Street Renewal bought it for a song last year at auction before selling it in May to the Luxor Capital entity.

Front Yard Residential, one of the institutional landlords buying homes in Louisville, said in an investor presentation last month that in the “affordable housing” segment of the market in which it is active, tenants are “less likely to leave to purchase a home.”

They make damn sure of that! Continuing…

While various institutional firms are the ultimate owners of rental homes in Louisville, one company – Main Street Renewal -- is at the center of the local activity, according to WDRB’s review.

A subsidiary of Amherst Holdings, a private investment firm in Austin, Texas, Main Street Renewal owns or manages rental homes in 15 states, according to its website.

Main Street Renewal purchased all 414 homes in WDRB’s review, from late 2015 to earlier this month. It buys the homes through subsidiaries with names that might resemble WIFI networks – MUPR 3 Assets, EPH 2 Assets, AVRM 5.

They now own 45,000 units in the area and no longer resale anything, they keep them and put them for rent.

The company has sold about half of the Louisville houses to other investors – companies linked to Luxor Capital, Global Atlantic Financial Group in New York and Front Yard Residential, a publicly traded rental homeowner based in the U.S. Virgin Islands.

Main Street Renewal declined an interview for this story.

Records show Main Street Renewal has been active at public foreclosure auctions -- one source of cheap homes that can quickly upgraded and put on the rental market.

Main Street Renewal has also purchased dozens of properties at a time from local landlords and from homebuilders, and made individual deals through aggressive, low-ball offers on the public market.

Steve Adams, an agent with Bob Hayes Realty, listed a three-bedroom home in north Bullitt County for $122,900 on Monday, posting a single photo of its exterior.

The next day, a representative of a broker based in Arizona emailed an offer for the home from Main Street Renewal – no appraisal needed because the company would pay cash.

So, this was in 2018, when AI was in its infancy, as far as the public is concerned, imagine how fast they can swoop in and snatch these homes using AI now. There’s no way regular people can compete.

To be clear, how this works is you find a home you’re interested in and contact the real estate agent listed, they setup the walk-through, you do the walk-through, you decide you want it, they contact the listing agency, and it’s taken off the market right then. Now you start your process with the broker, and the bank, and what happens is Main Street Renewal, if they get their eye on the house, apply tactics to pull it out from under you. They might come in with cash-in-hand, hard to turn that down, right? All done electronically. It’s not like, a person showing up with a briefcase of money, it’s more like an email, with a money control number. If that doesn’t work—and it normally does—they’ll make a larger offer, that the seller can’t turn down, and the individual buyer can’t beat. Most of the time though, using AI, they’re the first person to make an offer and the house disappears from the market, like Casper’s mean uncles. The example from WDRB said they bought that house based on one exterior photo! Then it was gone, poof!

The People Respond, Is Anyone Listening???

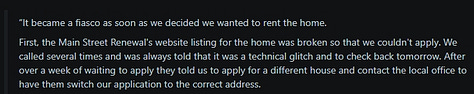

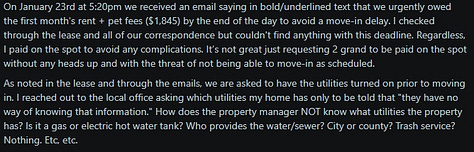

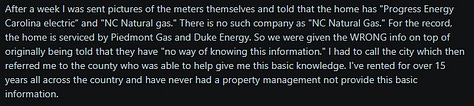

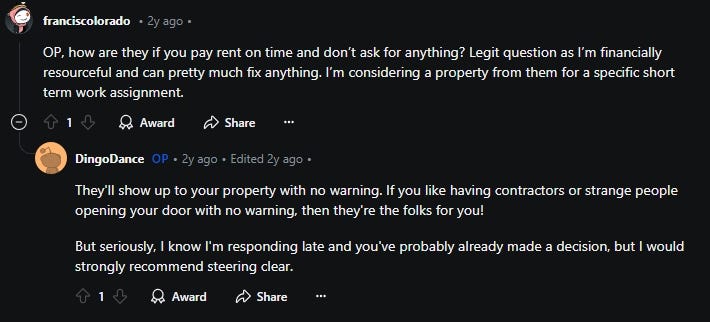

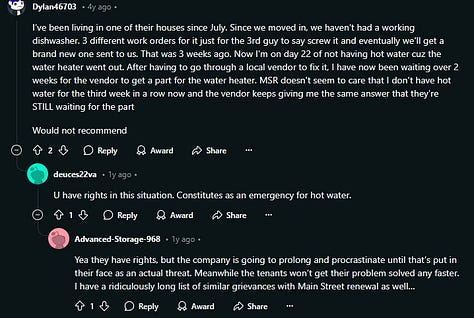

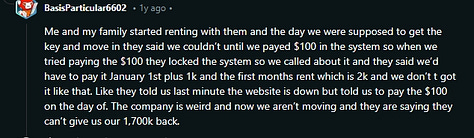

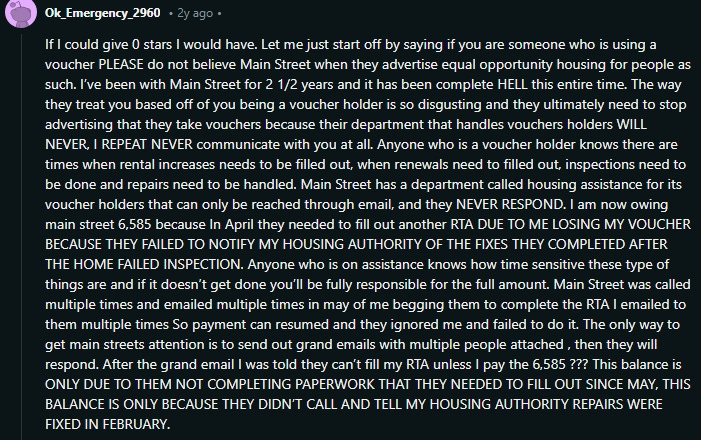

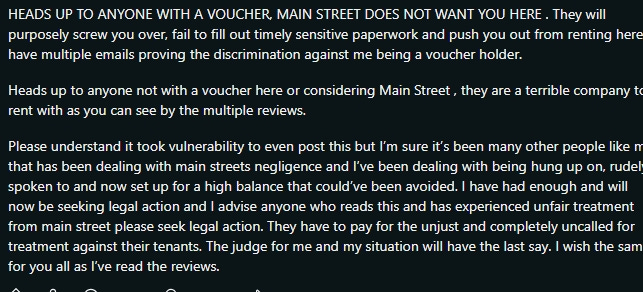

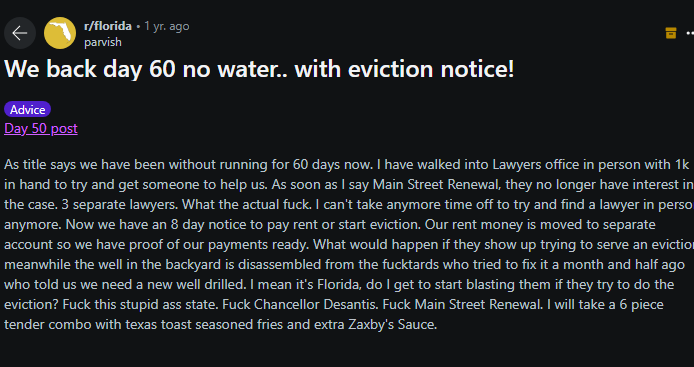

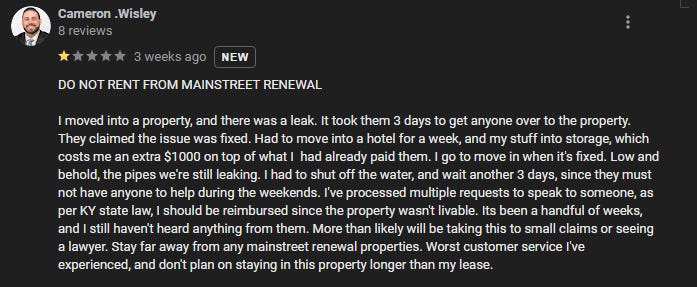

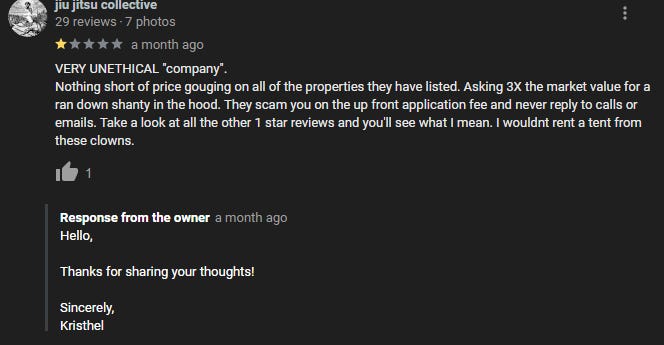

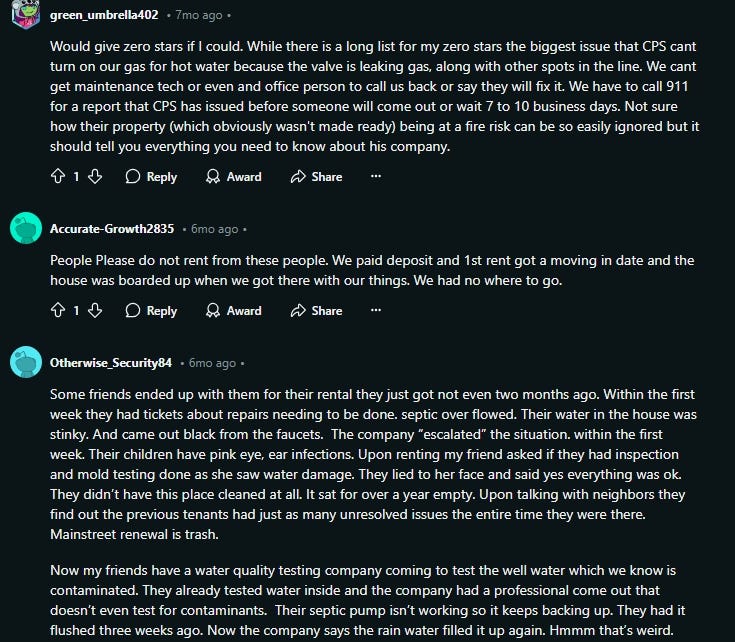

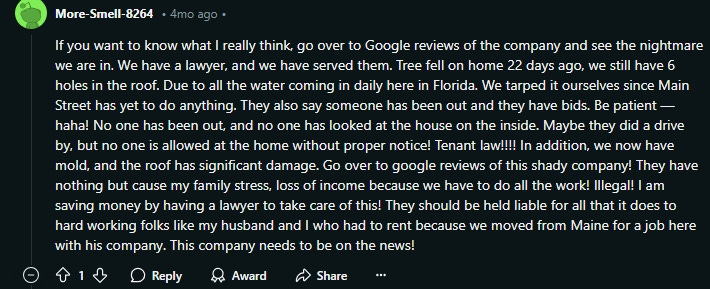

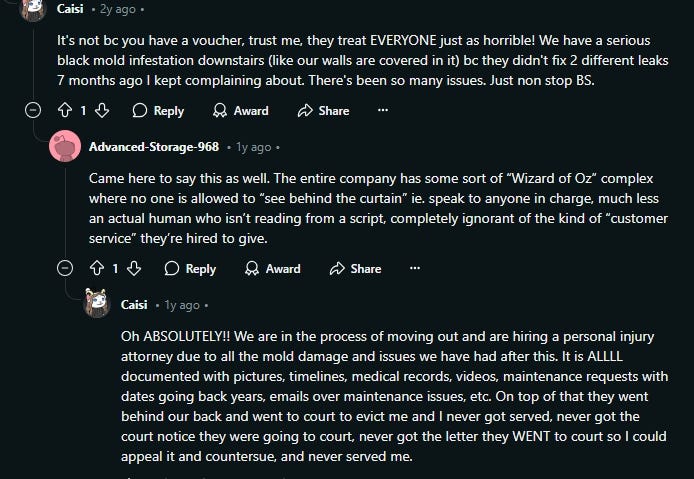

On several internet forums, including Reddit and the Better Business Bureau, the people are responding. There’s an outpouring of nightmarish stories from as far back as 10 years ago, to as recent as yesterday, and the through narrative you hear repeatedly in these stories is What can we do?! Does anyone have a contact for these people? Where else can we turn? Where indeed?

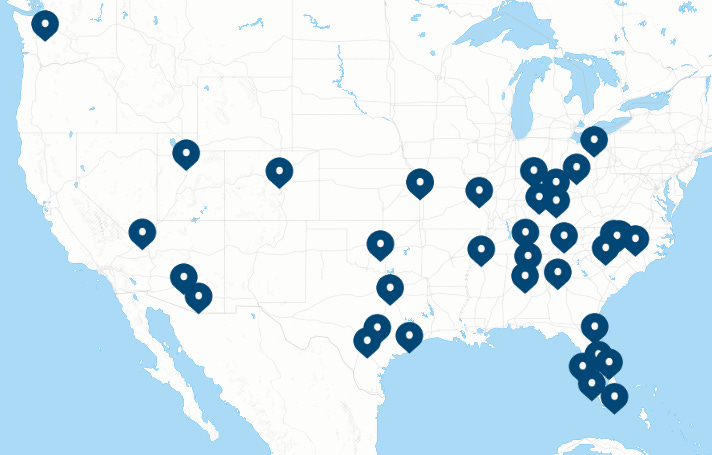

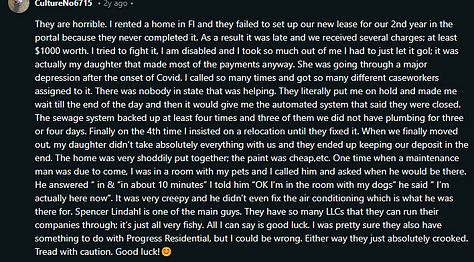

So, on one level they’re making it impossible to buy a home, extinguishing ownership by the people, but they also have terrible business practices, making them essentially slumlords, and an all-around shitty place to do business with, and no matter how many complaints they get, what can you do?! They own everything! And what they don’t own yet, they will. The Better Business Bureau has 965 reviews on them with an average rating of 1 star (because 0 isn’t an option). On Reddit I found 7 positive stories out of 500, and those 7 were things like “I’ve heard from other people dealing with them that they were really bad, but so far, so good.” I’m here to say so far, so good, is not an ok standard for a company operating a monopoly! If you think I’m being hyperbolic, consider this, I started looking at this as an observation that my significant other and I made. We were looking for a home and every one we looked at, everywhere we turned, we seen the same company, Main Street Renewals, we tried to rent from them and they denied us before we even finished the application, so we tried to find somewhere else, we went to a Real Estate Agent, he eventually found us a home—which will be later in this series, we uncovered some creepy crawly figures at our own expense in the process—but not before expressing his struggle on the frontlines of this battle. So, now I’m finally writing about it and after one Google search I see that this company is pulling the same shit all across the country! I’m talking Louisville, KY, Charlotte, NC, Arizona, Nashville, Fort Worth, Kansas City, Memphis, Gwinnett, Birmingham, St. Louis, this is fucking insane. My mind just got blown! Jacksonville, New Braunfels, TX, Raleigh, Tallahassee, Knoxville, Houston! Those are the ones who make it to the internet, imagine how many thousands are just sitting in it, hoping it gets better.

People from all across the country are reaching out online for help because nobody is listening. When you call this company, the company they’re renting from, they get a frickin AI automated call service and if you persist you get a call center located, probably in India. If you keep on from there, eviction. Here’s some of their stories, I can’t include them all, but I will include the most egregious from each town. Then we’ll go a little deeper into the ownership of this corporate hellscape!

Continues…

Another Google Review…

And more…

Knoxville:

Orlando: Here’s that BBB link from the story below (there’s 196 pages of complaints).

This next review is infuriating! MS responds and its so damn frustrating!

(N)ew homes always become available, so please keep searching at (then lists website)

So, they can collect another $50 from ya every time you try to apply. Fucking scumbags!

North Carolina…

Fort Worth:

Birmingham gets it!

Here’s the link from the following story.

Here’s one from Indianapolis…

Kansas City:

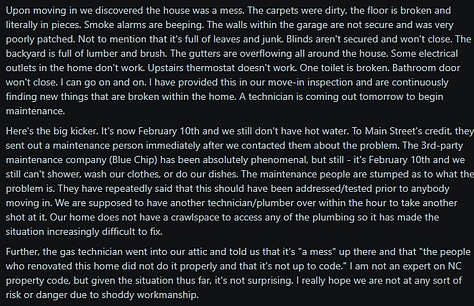

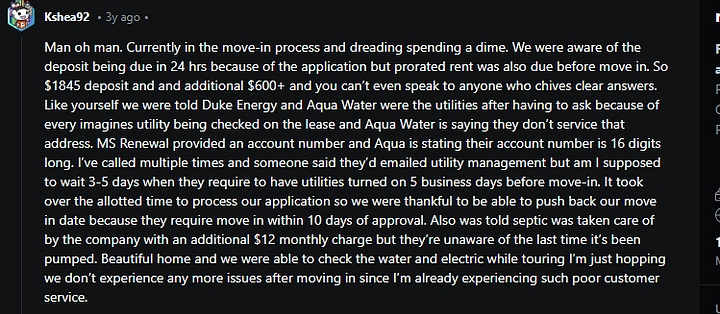

Raleigh, NC (American Horror Story!):

Here’s an interesting story, more on this later…

*By the way, they refused to comment on my story.

Okay, that’s enough, but there are thousands more. What it sounds like, after reading thousands of reviews, is most of these homes appeared great in the pictures, looked nice in the walk-through—if they got a walk-through—but when it came time to move in, something was fucked up and there was no one there to get help from. No one to contact, nothing but a robot to send a message about a problem that needs immediate attention! One person was there for 6 months without running water. Who knows if they ever got it. This is the business of providing people with a fucking sanctuary, you can’t delegate that to a fucking robot! Now for the million. dollar. question. Who is they?

Who the fuck owns this place? Is it Black Rock? Let’s peel off another layer…

“Amherst Holdings” is “Holding” Us Down

Layer by layer, the truth is revealed.

Institutional investors may control 40% of U.S. single-family rental homes by 2030, according to MetLife Investment Management. And a group of Washington, D.C., lawmakers say Wall Street needs to back away from the market.

—CNBC, in 2023

What we're saying is don't have private equity buying up single-family homes,— —What's outrageous is your tax dollars are helping Wall Street buy up single-family homes! —Rep. Ro Khanna in an interview with CNBC.

“The single-family rental industry got its start with government backing in the fallout after the 2008 financial crisis. "It was that rare opportunity that attracted the institutions to build a portfolio out of these foreclosed properties," said Steven Xiao, an assistant professor of finance and managerial economics at the University of Texas at Dallas.”—Article by CNBC

“It's almost a captive market,” said Jordan Ash, director of labor-jobs and housing at the Private Equity Stakeholder Project. “They've been very explicit about how people are shut out of the homebuying market and are going to be perpetual renters.”—One more quote from the same CNBC article.

Amherst Holdings:

A private investment firm in Austin, Texas, with $20 billion under management.

MSR, is a subsidiary of Amherst Holdings that owns or manages single-family homes in the Midwest and Sunbelt.

Main Street Renewal is a property acquisition, repair, and management business that focuses on renovating homes and leasing them for affordable prices. The company uses artificial intelligence and data modeling to find properties and make offers on them.

So, I’m not necessarily a cynic on AI, I understand that anything can and will be used for evil, but I must believe the good outweighs the bad. For instance, I worked for a day labor company and was sent out to RC Cola, where they make and bottle RC, and Big Red and Sunkist, and back then my full-time job was at a packaging plant that did everything by hand. When I walked into RC I was horrified to find, what they called the million-dollar line—which I’m convinced costed much more than that—was an unbelievable, fully automated… everything doer, from loading the plastic that actually made the bottles, filling them, bundling them, twisting on the lids! Putting the cases on a pallet, wrapping the pallet in plastic, and loading the pallet into the truck. The place stayed cool, so the drinks stayed cold—which probably sucked in winter, but this was summer—the thing was unbelievable, my job was simply to watch for deformed lids and pull one out and check it every 15 minutes, but at that time what I seen was unemployment, homelessness, eating at a soup kitchen, but as I’ve went on my thinking has evolved a bit. I now think that automation and AI are good because it frees us up to do things that are more fulfilling, less back breaking, more purposeful, BUT….

If AI is being used by someone living across the country, to steal homes right out from underneath working people's noses to increase their portfolio, at the expense of the people who want to be a part of that community, this is the evilest use that I can imagine. That’s what we are looking at here. It’s not quite Skynet but, damn near it!

It’s a parasitic corporation, feasting off of places who are functionally illiterate—not that we could stop them if we wanted to—to say the least.

What MS Renewal is, actually, is a shell company for Amherst Holdings, and Amherst Asset Management.

This is to shield themselves from liability, in case someone gets hurt, or God forbid killed, from the condition they’d rented a home in or refusing to fix something, or maybe they're just getting a real bad reputation for being a dog shit company, the blame will always fall on MS Renewals, not Amherst Holdings, but when you look a little closer, they are the same!

To encapsulate this, let’s use AI against them and ask the question:

Can Management Companies Be Sued

Yes, management companies can be sued. Here’s a breakdown of the information provided:

Common lawsuits against property management companies:

Maintenance issues

Breach of contract

Negligence

Unlawful eviction

Fraud (e.g., misrepresenting property finances)

Liability for managers:

Managers can be held personally liable for their actions, including:

Discriminatory practices (e.g., sexual harassment, age discrimination)

Failure to maintain accurate records

Inflated performance evaluations

Inconsistent enforcement of policies

Lack of knowledge about employment laws (e.g., FMLA, ADA)

Serving process on management companies:

If a corporation or LLC is being sued, process can be served on the registered agent at the registered office (address) during normal business hours.

Failure to designate a registered agent can lead to administrative dissolution or alternative methods of service, which may result in untimely or no actual notice of the lawsuit.

Tenants’ rights to sue property managers:

When property managers fail to meet their responsibilities or act negligently, tenants have the right to sue them.

Property managers must diligently fulfill their duties, maintain accurate records, and stay updated with relevant laws and regulations to minimize the risk of legal disputes.

Red flags for suing a bad boss:

Employees have the right to sue their bad boss for various reasons, including:

Illegal activities (e.g., whistleblower retaliation)

Unlawful termination

Discrimination

Failure to provide reasonable accommodations

Violation of employment laws (e.g., overtime, FMLA)

In summary, management companies can be sued for various reasons, including breach of contract, negligence, fraud, and discriminatory practices. Managers can also be held personally liable for their actions. Tenants and employees have the right to sue property managers and bad bosses, respectively, for violations of their rights and laws.

I’m no genius here, I’m just rooting around, digging up the evidence that’s available, but a question for the reader, assuming every complaint listed above is totally true…How about this, let’s be real conservative here and say 30% are true, how many would it take for you to never do business with this company ever?!

We are talking about people's homes. Their fucking sanctuaries! How many violations of your personal sanctuary would you allow before you say, this is bullshit someone has to be liable! How much would it take for you to say, NO! I will NOT work hand and fist every day to provide sanctuary to my family for you to violate their fucking rights!? Someone has GOT to be held accountable! When they have an entire system setup to absolve themselves from liability and pass accountability to a sock puppet!

Well, that is what Main Street Renewal is for Amherst holdings. It’s a front to protect Amherst Holdings.

So, who’s hiding behind Amherst?

Introducing the Keeper of the Keys—Sean Dobson

“We want to get to 1 million homes in the next 15 years or so,”

“They said I was nuts, that this was an impossible business that would suffer ‘death by a thousand cuts,’”

Who is he?

Sean Dobson took a temp job at a brokerage firm, basically as the office runner, “you know, running around, picking up people’s dry cleaning, grabbing lunch, opening the mail, that sort of thing.” It was Houston, TX, the summer after he graduated from high school, 1987. He was told about the job by a friend of the families. Who said “what an interesting sort of industry it was. This is back when mortgages were sort of a backwater of the fixed income market. So, they were traded a little bit like ‘Muni bonds.’” While holding down his job as office runner he was offered a more permanent position on the Research Team, then began his rise through the ranks, taking over the research team and soon after, taking over the trading platform. By 1994, him and a group of like-minded individuals went out to start their own business and that was the predecessor to Amherst. At Amherst they specialize in mortgage risk, knowing what kind of risk each mortgage allows, I have no clue what that means so here it is in his words:

So, back then it was really just mortgage-backed securities and structured products that were derivatives of mortgage-backed securities. We sort of carved out a name for ourselves in quantitative analytics around mortgage risk. And that’s still a big core competency of Amherst, understanding the risks of mortgages are kind of boring, but they’re also very complicated. The borrower has so many options around when to refinance, how to repay, if they repay. It takes quite a lot of research, quite a lot of modeling, quite a lot of data to actually keep up with the mortgage market. It’s really 40 million individual contracts, 40-50 million individual contracts and a million different securities. So, it takes quite a— we’ve built an interesting system to allow you to sort of monitor all that and price it in real time.

*So he created a program to do that for him.

The interviewer then asks him,

(O)ne would think, especially from Texas as opposed to being in the thick of Wall Street, you might have seen some signs that, that perhaps the wheels are coming off the bus. Tell us about your experience in the 2000s. What did you see coming?

Which is the question. See, the movie The Big Short was Sean Dobson’s story. Sean, during the time that people were making a killing off of sub-prime mortgage's, looked at those loans through his companies very detailed, very data-rich, method that they’d been developing since 1994, something wasn’t right. He checked, and checked again, and everything he had learned in his almost 20 years in this business, told him disaster was approaching. He took this data and went on the road, doing what I imagine as a speaking tour that ends with “Tomatoes and Boo’s” at the end, not to be confused with ‘booze’.

No one believed him. So, the next move came naturally, I’m sure:

The seeds of his big score were planted during the housing bubble, when his models predicted a disaster in “Alt-A securities,” packages of loans granted to homeowners who had often refinanced multiple times. “The market was predicting a default rate of 5%, and our models showed it would be 30% [even] if home prices didn’t fall at all,” Dobson recalls. He recruited a group of investors that took short positions in Alt-A, reaping a $10 billion profit—10 times the investment, according to Dobson—when home prices tumbled.

So, he showed them. Made him a nice chunk to retire on and retire he did….

Of course not. That was just the appetizer.

The Robo-Landlord

In the past big-money funds would buy apartment complexes because of the amount of money coming in each month and the centralization of maintenance, but Sean Dobson has a different plan with his money.

His goal is to have 1 million units under his management in the next 15 years, he said this, by the way, in 2019, when he had 16,000 units. He now has 50,000 units and rising every day. He’s able to manage this vast expanse of homes using AI technologies, but no matter how well he thinks this is working out, it’s not, it never will, because AI does not have compassion for the lives people are living and the nuances that change from situation to situation. Other people have warned him about this, and the same way that the people he warned about the coming housing crisis in 2005, he heeds no warnings about the crisis he’s heading straight towards, and just like them he’s leaving actual lives hanging in the balance of his ego-trip!

Check out how he’s able to scoop in and take homes under the real estate agents noses:

Choosing homes there is the job of Amherst’s highly automated purchasing system. In its 19th-floor office on New York City’s Madison Avenue, a dozen buying specialists screen leads on their workstations, delivered by a proprietary program called Explorer, an offshoot of the software Dobson developed to price mortgages. Each morning, the team gets alerts on newly listed homes that meet its price range and geographic criteria—around 1,400 listings a day.

For each “first cut” listing, Explorer estimates the costs of renovation. This is machine learning at work: The estimate is based on Amherst’s experience with homes of similar age and size in the same or nearby neighborhoods. In an older home, this might include replacing the HVAC system; for one whose listing photos suggest wear and tear, it might include a new roof. (Team members help the software make that call.) Explorer has become so precise, Negri says, that the actual renovation costs average within 5% of the estimates.

Explorer also runs a separate calculation, finding three homes being rented within a two-mile radius that are close in age, size, and bed-and-bath specs to the newly listed home. Machine learning helps the software estimate what each house would rent for based on these “comps.” Explorer then churns out an estimated “rental yield”—the net rent after such expenses as taxes and maintenance, divided by all-in cost.

If that yield meets Amherst’s target (which Fortune estimates is between 5% and 6%), the team will make an offer. About 20% of each day’s listings qualify; Amherst bids on those candidates no more than 12 hours after they’re first listed, making all-cash offers. Around 10% of its offers—on roughly 30 homes a day—get accepted and go to contract. Amherst dispatches inspectors to assess each home’s condition during the grace period. Unless they find fatal surprises—such as a cracked foundation—the houses pass muster and join the Main Street Renewal portfolio.

In order to reach his goal of a million homes in 15 years, he will need to buy like 60 homes a day. Therefore, it's not crazy to me when I see that he is going on news shows to try to get homeowners to sell their homes, obviously so he can buy them:

I can’t find the video where he said this, but I did find a great video of a youtuber reacting to it, just 7 months ago, so he must have done this recently, and he makes some pretty solid points (Transcript below the video):

“Sell your home and rent, yes, folks according to Sean Dobson, CEO of Amherst he is saying it is a good time to sell your home, and rent. The notion behind this is, of course, you will buy back later, you will time the market, all of those things. I do want to point out one thing about Sean. Sean Dobson is the CEO of Amherst, if you do not know who Amherst is, let me just tell you, they own 44,000 rental homes! So, could the CEO be talking his book, say, ‘hey take all your equity out of your home, come rent one of my places.’ I will let you be the judge.

It is pretty interesting to me, because as the CEO of Amherst, I believe one of his jobs is to maximize the return to shareholders, right? It's one of the jobs of an executive, and if Sham Dobson (Sic) truly believed it was time to sell single-family homes and rent, what would Sean do? He owns 44,000 of these things, wouldn't he sell? Wouldn't he sell each and every home, and come back later? Me think so! Yes. I also think it is very odd when somebody recommends that you sell, perhaps your best asset, and folks to be clear, I'm not talking about the home. I'm talking about 30-year fixed rate debt, at or below inflation. Folks some of you have 30-year debt below 3%, getting rid of that is unconscionable! Unless you have to, there are life situations where even if the rate is a great asset, you don't have a choice, that is not lost on me, but let's be clear, for the average person, who was lucky enough, who was fortunate enough, to have purchased in 2020, ‘21 ‘22 or shoot, let's be clear refi’ed in ‘21 or ‘22, you now have an asset called 30-year fixed rate debt, at or below inflation. For many of you, that will be the best asset you ever own, for many of you, you will stay in that home probably longer than you expected, and for many of you, you may become what's called an “accidental landlord” meaning, it is time to turn that into a rental, and you'll just do a 5% down purchase on your next home.

So, it is pretty interesting when I think about the housing market, and this whole idea of selling now, and buying back later. I think about all the people who have tried to time markets, and again I understand the math. I understand affordability, I understand in lots of locations rent is below the cost of ownership. I get it, but that's about today's purchase, we are not looking at individuals who have fixed rate mortgages. Who now have, frankly, more disposable income than they've ever had because they purchased or refi’ed. One of the reasons the consumer has been going strong to this point, is because they took advantage of the system. They got 30-year debt below four, below three, and now they have fixed rate debt. Why would you get rid of fixed rate debt, and rent, which is a variable expense, it makes nearly no sense to me, but again, if Sean Dobson the CEO of Amherst believes that it's the peak of the market, he should sell his homes, and if he truly believes that, we'll see it in the next quarterly findings, Amherst should be a net seller.”

I’ve never wished for someone to fail at anything in my life, but I hope this guy fails. If he is able to take control of every unit in any area of our country, he can literally change the culture. He has a ban on certain breeds of dogs for God's sake, that means he can control those animal’s existence. He could possibly control the housing market and say what a home is worth because, well, he owns them all!

I’m very much a kid of my generation. I live on the internet, I fall asleep most nights with a laptop on my lap, I love technology! But even I can recognize when something sounds like a disaster waiting to happen. His own advisers warned him “that this was an impossible business that would suffer ‘death by a thousand cuts.’” This article is maybe 50 of those thousand cuts. The number of complaints I found about this specific company was vast!

He, however, has no bearing on this, since it will be the American middle class where the cuts will bleed. And he won’t know he’s bled out until it’s too late. And it all crashes down…

Thank you for reading. Act Two: Coming Soon.

Editor-in-Chief

I've gotten multiple cash offers on my home, no need to look at it. I worry about people who may be in trouble financially thinking this is a great way out. It is not! Private property is the one true way to build any, even a little, wealth in this country. Hold on to it. These assholes need to be stopped. Class action. I wonder who is protecting this. I would have expected Kahn to grab this.